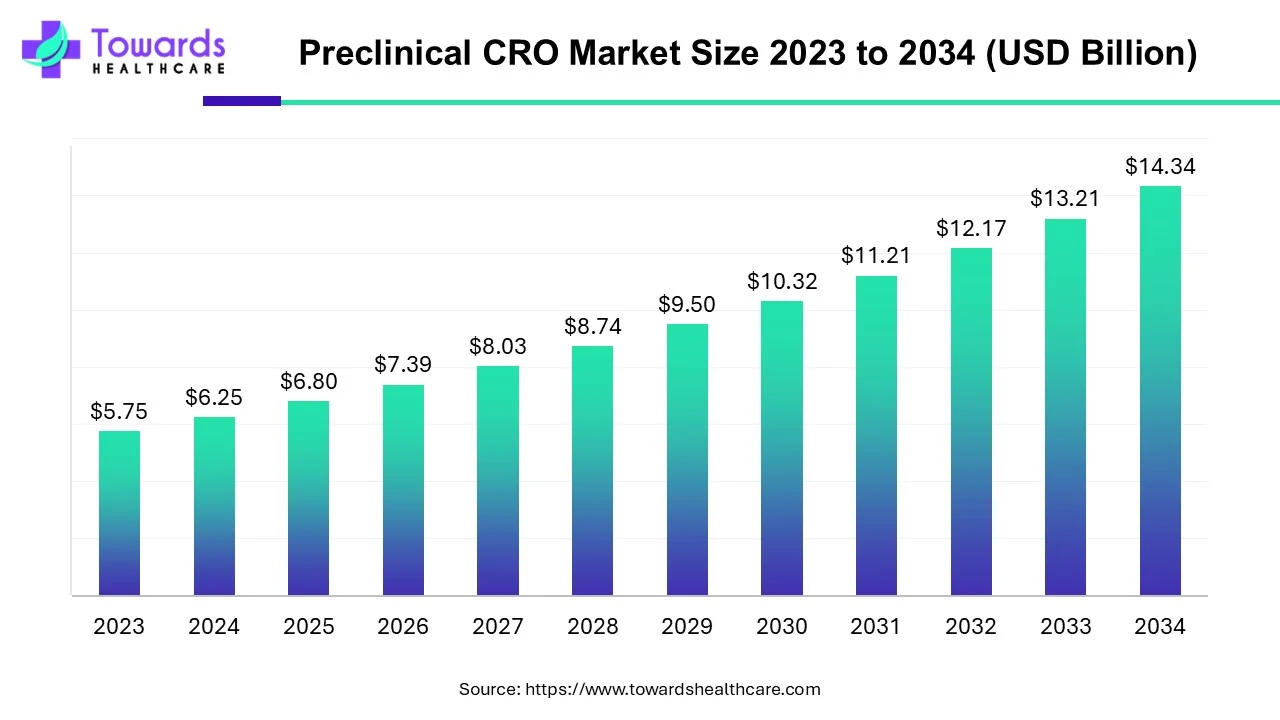

Preclinical CRO Market Size at USD 6.8 Billion in 2025, Forecasted to Grow at 8.73% CAGR Through 2034

The global preclinical CRO market size is calculated at USD 6.80 billion in 2025 and is expected to reach around USD 14.34 billion by 2034, growing at a CAGR of 8.73% for the forecasted period.

Ottawa, July 16, 2025 (GLOBE NEWSWIRE) -- The global preclinical CRO market size was valued at USD 6.25 billion in 2024 and is predicted to hit around USD 14.34 billion by 2034, a study published by Towards Healthcare a sister firm of Precedence Research.

Get a quick preview of key insights and trends shaping the preclinical CRO market: https://www.towardshealthcare.com/download-sample/5442

The growth of the market is driven by the major pharmaceutical companies and increased research and development in the developing regions, furthering the growth of the market.

Key Takeaways

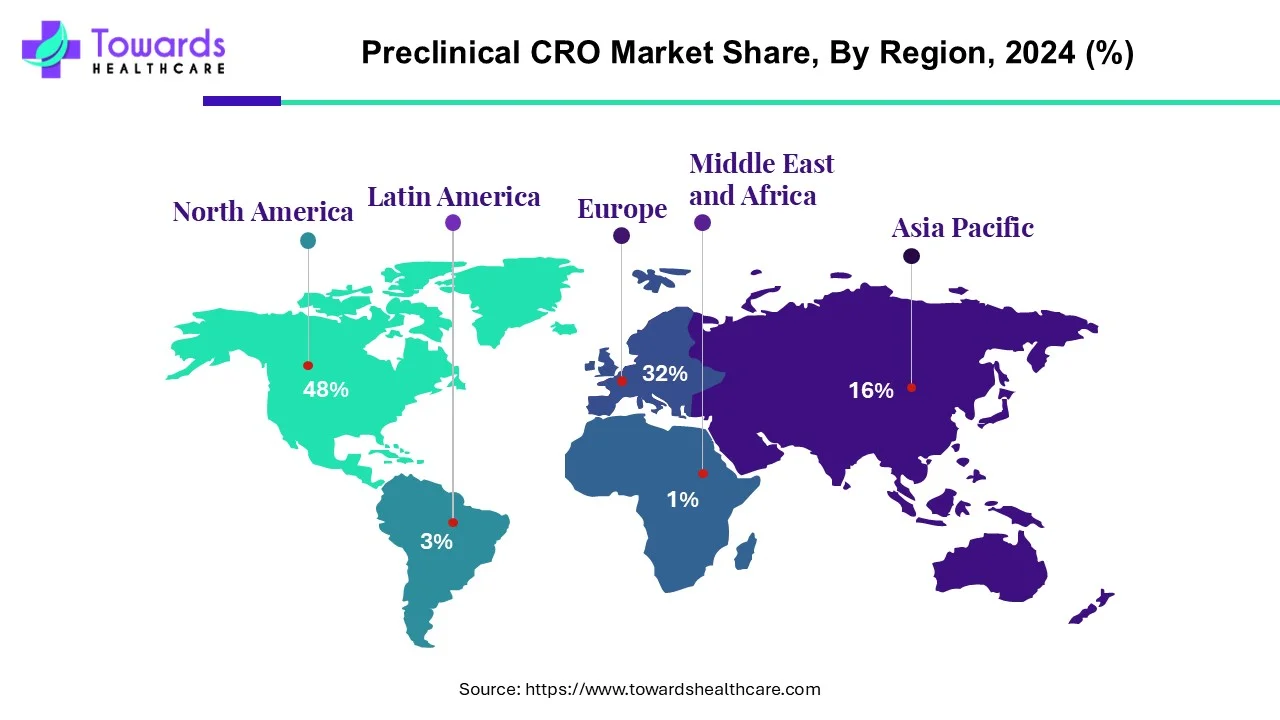

- North America led the global market with the highest market share of 48% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the forecast period, 2025 to 2034.

- By service, the toxicology testing segment accounted for the largest revenue share in the global preclinical CRO market in 2024.

- By service, the bioanalysis and DMPK studies segment is anticipated to grow at the fastest rate during the forecast period.

- By model type, the patient-derived organoid (PDO) model segment held the largest share in 2024.

- By model type, the patient-derived xenografts (PDXs) model segment is expected to expand at a significant CAGR throughout the forecast period.

- By end use, the biopharmaceutical companies segment held the largest shares in 2024.

- By end-use, the government and academic institutes segment is expected to register the fastest growth during the forecast period.

Preclinical CRO Market Overview & Potential

A preclinical CRO (Contract Research Organization) offers vital research services mainly during the early, preclinical stage of developing drugs and medical devices, before human trials start. These organizations perform studies, including lab and animal testing, to assess the safety, effectiveness, and pharmacological characteristics of new treatments or devices.

This critical phase gathers necessary data for regulatory filings such as Investigational New Drug (IND) applications and ensures safety before human testing. Preclinical CROs are essential in the initial development phases by delivering testing, data collection, and regulatory assistance, thereby supporting the progress of new therapies and medical innovations.

Access detailed market data, segment breakdowns, and growth projections in one place: https://www.towardshealthcare.com/download-databook/5442

What Are the Key Growth Factors Responsible for The Growth of The Preclinical CRO Market?

The key growth drivers responsible for the growth of the market are the increased complexity and cost of drug development, rising prevalence of chronic diseases, regulatory stringency, and advanced technological advancements are the key growth drivers which help in the growth of the market. The growth of the biotechnology sector, with its focus on biologics, cell and gene therapies, and other advanced therapies, is in increasing demand. The increased research and development by the pharmaceutical and biotechnology companies further boost the growth of the market, supporting the expansion.

What Are the Growing Trends Associated with The Preclinical CRO Market?

-

Advancements in Technology

The technological advancements, like the integration of AI, high-throughput screening, and in vivo imaging to enable more efficient and personalized research, are a growing trend.

-

Increased Outsourcing

Increasing outsourcing by pharmaceutical and biotech companies to leverage specialized expertise, reduce costs, and accelerate drug development fuels the growth.

-

Focus on Specialized Services

The growing demand for specialized services like personalized medicines and biologics, and testing procedures further drives the growth of the market.

-

Growing Demand for CROs

The growing demand to enhance and improve efficiency for substantial growth in the market and testing boosts the demand.

What Is the Growing Challenge in The Preclinical CRO Market?

The key challenge that limits the growth of the market is the regulatory hurdles, like complex compliance, time-consuming approvals, data integrity maintaining high data quality in large-scale research is a challenge which hinders the growth of the market. The cost and complexity of maintaining quality and reliability are a major challenge that hinders the growth of the market.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Regional Analysis

How Did North America Dominate the Preclinical CRO Market In 2024?

North America led the global market with the highest market share of 48% in 2024. The growth of the market is driven by the increasing research and development investments, the rising prevalence of chronic diseases, and the presence of large major pharmaceutical and biotechnology companies, which fuel the growth of the market in the region. The well-established healthcare infrastructure and strong presence of major companies like Charles River Laboratories, LabCorp Drug Development, and Eurofins Scientific further fuel the growth of the market. The growth of the market is also driven by increased cost reduction and the ongoing development in therapeutic areas like gene therapy and neurodegenerative diseases, further fueling the growth of the market and supporting its expansion of the market.

Preclinical CROs in the U.S. are expanding rapidly due to rising demand for faster, cost-effective drug development. These organizations offer specialized services in toxicology, pharmacology, and bioanalysis, helping streamline R&D pipelines. Technological advancements and regulatory complexities are driving sponsors to outsource, fostering deeper collaborations and innovation within the life sciences sector.

Canada’s preclinical CRO sector is scaling rapidly, notably in Ontario and Quebec. Providers like BenchSci (AI-enabled target screening) and IonsGate (expanded toxicology services) enhance provincial R&D pipelines. Altasciences’ Mississauga labs handle diverse in vivo models. Partnerships with Health Canada and CIHR grants support facility expansion and deeper pharma-CRO cooperation.

Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting

What Made Asia Pacific Significantly Grow in The Preclinical CRO Market In 2024?

Asia Pacific is expected to grow at the fastest CAGR over the forecast period, 2025 to 2034. The growth of the market is driven by the offering of cost-effectiveness of research and development and the offering of effective solutions for preclinical research, which attracts national and international pharmaceutical companies for investments, which increases the growth of the market in the region. The growth is also driven by the expanding biopharma companies, and expanding research also demands and needs preclinical CRO services. Additionally, advancements in personalized medicines and oncology research in the region, with government support and infrastructure due to an increase in clinical trials, drive significant growth and expansion of the market in the region.

Chinese preclinical CROs led by giants like WuXi AppTec and Pharmaron have built globally compliant GLP labs in Suzhou, Shanghai, and Wuhan. They now offer advanced in vivo ADME/Tox, NHP models, isotope-based DMPK, and continuous-infusion rodent studies. High-tech-park clusters and regulatory accreditation drive international-grade services.

India’s preclinical CRO landscape is expanding in Hyderabad, Bengaluru, and Pune. Providers like GVK Bio and Jubilant Biosys operate GLP-certified toxicology and pharmacology labs. Emerging capabilities include canine and NHP models, PK/PD biomarker development, whole-body autoradiography, and AI-assisted data analytics. Collaborations with DST and DBT bolster translational study infrastructure.

Segmental Insights

By service

How Did Service Segment Dominate the Preclinical CRO Market In 2024?

The toxicology testing segment accounted for the largest revenue share in the global market in 2024. Toxicology testing services in the market play a vital role in assessing the safety profile of new drug candidates before they enter clinical trials. These services help identify potential toxic effects on different organs and systems, ensuring regulatory compliance and minimizing risks to human health. With increasing drug development activities and stringent safety regulations, demand for reliable toxicology testing is growing rapidly. This supports the expansion of preclinical CRO services, enabling pharmaceutical and biotech companies to advance their pipelines efficiently and safely.

The bioanalysis and DMPK studies segment is anticipated to grow at the fastest rate during the forecast period. Bioanalysis and DMPK (Drug Metabolism and Pharmacokinetics) studies are essential services offered by preclinical CROs to evaluate the absorption, distribution, metabolism, and excretion of drug candidates. These studies provide crucial data on drug behaviour in the body, guiding dose selection and safety assessments before clinical trials. The growing need for precise pharmacokinetic data to meet regulatory requirements and optimize drug design fuels the demand for these services, supporting market growth and accelerating drug development timelines for pharmaceutical companies.

By model type

Which Patient-Derived Organoid Model Segment Dominated the Preclinical CRO Market In 2024?

The patient-derived organoid (PDO) model segment held the largest share in 2024. Patient-derived organoid models in the preclinical CRO market are gaining significant attention due to their ability to closely mimic human tissue and tumor microenvironments. These 3D models, developed from patient-specific cells, enable more accurate prediction of drug responses and toxicity compared to traditional models. They support personalized medicine approaches and improve the success rate of drug candidates by providing better translational relevance. The increasing demand for more precise and human-relevant models drives the adoption of patient-derived organoids, fueling market growth.

The patient-derived xenografts (PDXs) model segment is expected to expand at a significant CAGR throughout the forecast period. Patient-derived xenograft (PDX) models are increasingly used in the preclinical CRO market due to their high predictive value for human clinical outcomes. In these models, tumor tissues from patients are implanted into immunodeficient mice, preserving the original tumor’s characteristics and heterogeneity. PDX models enable researchers to study tumor behavior, evaluate drug efficacy, and identify potential biomarkers more accurately. The rising focus on personalized medicine and the need for clinically relevant data drive demand for PDX models, supporting market expansion.

By end use

Which End Use Segment Dominated the Preclinical CRO Market In 2024?

The biopharmaceutical companies segment held the largest shares in 2024. Biopharmaceutical companies are major end users in the preclinical CRO market, relying heavily on these services to accelerate and streamline their drug development pipelines. By outsourcing preclinical studies such as toxicology, bioanalysis, DMPK, and efficacy testing, these companies reduce costs, minimize risks, and access specialized expertise and advanced models. This enables them to focus on core research activities and bring innovative therapies to market faster. The growing emphasis on biologics and complex molecules further fuels demand, driving market growth and expansion.

The government and academic institutes segment is expected to register the fastest growth during the forecast period. Government and academic institutes play a crucial role as end users in the preclinical CRO market, utilizing outsourced research services to advance scientific knowledge and support public health initiatives. These institutions often engage CROs for specialized studies, including safety evaluations, mechanistic research, and early-stage drug discovery, due to limited in-house resources or expertise. Their focus on translational research, new therapeutic approaches, and regulatory science drives the demand for high-quality preclinical services, supporting market growth and healthcare innovation.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Recent Developments

In April 2025, Debiopharm Research & Manufacturing S.A., a Swiss-based global biopharmaceutical company, launched a license agreement for the use of the AbYlink™ technology for preclinical services.

In November 2024, Thermo Fisher Scientific launched a suite of expanded CRO and CDMO services under its brand. The company has introduced to the market its Accelerator™ Drug Development, which Thermo Fisher is marketing as “360°” CDMO and CRO drug development solutions.

Top Companies and Their Contributions to the Preclinical CRO Market

| Company | Key Contributions and Offerings |

| WuXi AppTec | Offers end-to-end preclinical services in toxicology, pharmacology, and DMPK; strong in IND-enabling studies and global regulatory compliance. |

| Pharmaceutical Product Development (PPD) | Specializes in nonclinical safety studies, ADME, and bioanalytical services; strong support for early-phase compound selection and optimization. |

| Medpace, Inc. | Provides integrated preclinical trial design and execution; strengths in pharmacokinetics, toxicology, and disease models, particularly in oncology and cardiology. |

| Charles River Laboratories | Industry leader in in vivo and in vitro safety assessments, genetic toxicology, and pathology; offers extensive animal model capabilities. |

| PRA Health Sciences | Known for translational medicine and biomarker development, it combines lab and clinical data to enhance candidate evaluation. |

| PAREXEL | Delivers regulatory consulting, toxicology, and pathology services; known for integrating preclinical findings into clinical strategy. |

| Envigo | Offers regulatory toxicology, safety pharmacology, and metabolism studies; robust capabilities in GLP and non-GLP environments. |

| Eurofins Scientific | Provides comprehensive testing services including genotoxicity, ecotoxicology, and bioanalytics; also specializes in agrochemical safety. |

| LabCorp (Covance) | Delivers large-scale preclinical services in drug metabolism, bioanalytical chemistry, and regulatory toxicology. |

| ICON Plc | Offers early-phase lab services including preclinical feasibility studies, assay development, and integrated biomarker strategies. |

Browse More Insights of Towards Healthcare:

The global medical device CRO market was valued at USD 8.49 billion in 2024 and increased to USD 9.25 billion in 2025. It is expected to reach USD 19.9 billion by 2034, growing steadily at a CAGR of 8.98% from 2025 to 2034.

The biopharmaceuticals CRO market is showing strong growth and is expected to generate significant revenue, reaching hundreds of millions of dollars between 2025 and 2034.

The global healthcare CRO market was valued at USD 53.87 billion in 2024, grew to USD 57.66 billion in 2025, and is projected to reach USD 106.25 billion by 2034, growing at a CAGR of 7.04% over the forecast period.

The pharma CRO services market is expected to grow from USD 36.66 billion in 2025 to USD 87.03 billion by 2034, with a healthy CAGR of 10.04% from 2025 to 2034.

The preclinical advanced cell models market is also expanding rapidly and is forecasted to earn hundreds of millions in revenue between 2025 and 2034.

The global mRNA therapeutics CDMO market grew from USD 4.62 billion in 2024 to USD 5.15 billion in 2025, and is projected to reach USD 13.63 billion by 2034, growing at a CAGR of 11.37%.

The drug discovery as a service market was worth USD 21.3 billion in 2024, rose to USD 24.32 billion in 2025, and is expected to reach USD 79.82 billion by 2034, growing at a robust CAGR of 14.17%.

The CDMO services market for pharma and biotech is experiencing significant growth between 2024 and 2034, driven by a strong shift toward outsourcing by these industries.

The global cell culture media market increased from USD 6.9 billion in 2024 to USD 7.69 billion in 2025, and is projected to reach USD 20.32 billion by 2034, growing at a CAGR of 11.45%.

The small molecule CDMO market was valued at USD 72.81 billion in 2024, reached USD 78.01 billion in 2025, and is forecasted to hit USD 145.12 billion by 2034, growing at a CAGR of 7.14%.

Key Players List of Preclinical CRO Market

- Wuxi AppTec

- Pharmaceutical Product Development

- Medpace, Inc.

- Charles River Laboratories International, Inc.

- PRA Health Science, Inc.

- PAREXEL

- Envigo

- Eurofins Scientific

- Laboratory Corporation of America

- ICON Plc

- Intertek Group Plc (IGP)

- LABCORP

- Crown Bioscience

- PPD (Thermo Fisher Scientific, Inc.)

Segments Covered in the Report

By Service

- Bioanalysis and DMPK studies

- In vitro ADME

- In vivo PK

- Toxicology Testing

- GLP

- Non-GLP

- Compound Management

- Process R&D

- Custom Synthesis

- Others

- Chemistry

- Medicinal Chemistry

- Computational Chemistry

- Safety Pharmacology

- Others

By Model Type

- Patient-Derived Organoid (PDO) Model

- Patient-derived xenograft model

By End-use

- Biopharmaceutical Companies

- Government and Academic Institutes

- Medical Device Companies

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Unlock the complete preclinical CRO market analysis, with strategic insights and expert forecasts: https://www.towardshealthcare.com/price/5442

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.